Russia's economy is crashing, right?

A look at Russian economic resilience and why Western projections were wrong.

I’ve been enjoying this new Substack. I think you will too. This article from Axis Analysis is well sourced, well reasoned and makes points you are not seeing everywhere.

Benjamin

Putin visits Uralvagonzavod in Nizhny Tagil, February 15, 2024

In Western media, much is said and written about the Russian economy, almost always in a negative light, even before the war. Russia has often been portrayed as backward, with figures like the late U.S. Senator John McCain famously calling it “a big gas station.” These statements, while politically charged, are unnuanced and often inaccurate. The problem is that such narratives lead to flawed assessments, erroneous projections, and ultimately, misguided policies.

Western Misconceptions About the Russian Economy

Russia’s economy was widely expected to collapse after the introduction of severe sanctions in 2022. Initially, there was a major economic shock. However, by the summer, the Russian economy rebounded and began to grow. As of 2024, growth remains strong, exceeding 3%.1 In contrast, Europe has faced stagnation, experiencing the “boomerang effect” of its own sanctions. Economic integration with Russia, especially in energy, was underestimated, as was President Putin’s ability to swiftly redirect trade toward the Global South.2

Prominent voices like the Center for Analysis and Strategies in Europe, authored by Sergey Aleksashenko, Vladislav Inozemtsev, and Dmitry Nekrasov3, have highlighted how poorly Western analysts have understood Russia’s economic trajectory. Their report, “Dictator’s Reliable Rear: The Russian Economy at the Time of War,”4 underscores these gaps in understanding.

For example:

In April 2022, the World Bank predicted an 11.2% decline in Russia’s GDP by year-end, but the actual decline was only 2.1%.

In 2023, Russia’s economy grew by 3.6%, far exceeding the International Monetary Fund's (IMF) January forecast of just 0.3%.

For 2024, growth is expected to reach 3.8-4.0%, compared to earlier international projections of 1.3%.

These discrepancies reveal a deep misunderstanding of Russia’s economy among three key groups of analysts:

Long-time Russia specialists who view events through a Soviet-era lens, equating Putin’s policies with Soviet restoration.

Analysts working for Western governments or NGOs, who are incentivized to project confidence in sanctions and restrictions.

Former Russian politicians and experts opposed to Putin, whose analyses are often biased by their expectations of regime collapse.

This disconnect underscores a need for more objective, data-driven assessments that separate economics from ideology.

The Hybrid Model: Market Principles and State Oversight

A common misconception about Russia’s economy is that it has reverted to Soviet-style state control. While it is true that state-owned enterprises dominate sectors like oil, gas, and banking, the picture is more complex. Approximately half of Russia’s economy remains privately owned, and even state-owned enterprises operate in competitive environments.

Under Putin’s hybrid economic model, state oversight is balanced with market principles. For example, the Kremlin often sets up competing state-owned giants in the same industry. Sberbank and VTB in banking, or Gazprom and Novatek in gas, are just two examples where competition is encouraged to foster efficiency. Private businesses are also pushed to innovate, keeping the system dynamic.5

The success of this model lies in its ability to ensure state control without stifling competitiveness. For instance, Elvira Nabiullina, the head of Russia’s Central Bank, has maintained autonomy in decision-making, skillfully navigating crises and implementing policies that have stabilized the economy under extreme pressure. Her leadership highlights how Russia blends state control with professional economic management.6

Elvira Nabulina

Sanctions and Their Consequences

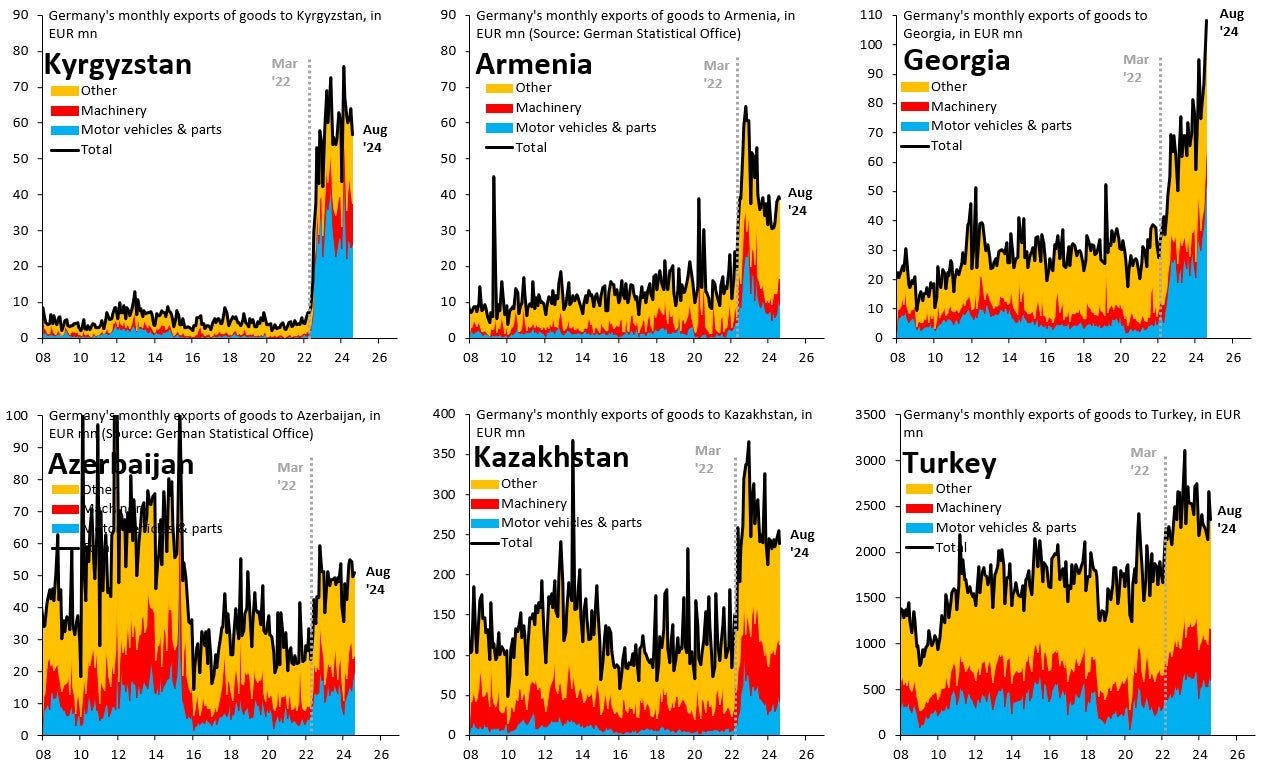

One of the key challenges facing Russia is the impact of Western sanctions. While sanctions have disrupted certain sectors, most notably gas exports, with Gazprom recording a $6.2 billion loss in 2023,7 they have not crippled the economy as intended. Instead, Russia has redirected trade through the Global South, circumventing restrictions. European companies, meanwhile, have found ways to continue trade with Russia indirectly via neighboring countries like Kazakhstan.

The failure of sanctions to fully isolate Russia underscores their lack of universal enforcement. Without the participation of major players like China and India, sanctions have largely rerouted trade rather than halting it. This fragmentation weakens their effectiveness and highlights the challenges of implementing a truly global sanctions regime.

German monthly exports of goods

Challenges and Risks Ahead

Despite its resilience, the Russian economy is not without problems. War-related spending has driven inflation to stubbornly high levels of 8-9%, with interest rates at a staggering 21%.8 Loss of access to Western technology could compound over time, slowing innovation and limiting long-term growth potential.

The civilian economy, however, remains strong. Businesses have adapted by retooling factories to replace Western technology, while rising real disposable incomes have fueled consumption. Contrary to assumptions that growth is driven solely by the military-industrial sector, the civilian sector has been a significant contributor to economic performance.9

Conclusion: A Need for Reassessment

The Russian economy faces significant challenges in the mid- to long-term, but it has so far proven remarkably resilient. Simply hoping that the economy will falter based on flawed projections and wishful thinking is not a viable strategy. Western policymakers must reevaluate why their sanctions regime has not had the desired effect and address its loopholes.

More importantly, this reassessment should include an honest analysis of the unintended consequences of sanctions, not only on Russia but also on global markets and Western economies. Without such reflection, the West risks continuing policies that fail to achieve their objectives while exacerbating global economic instability. A more strategic, nuanced approach is essential for navigating the complexities of the current global geopolitical landscape.

Find more here:

https://case-center.org/experts/

https://case-center.org/wp-content/uploads/2024/11/case-241112-en_fin2_compressed.pdf

https://www.intellinews.com/zao-kremlin-500013697/?archive=bne

https://edition.cnn.com/2024/05/03/business/gazprom-posts-first-loss/index.html

This article, as well as the sources it cites, mostly take the Russian government statistics at face value, which is not necessarily prudent. In particular, the inflation rate under 10% is highly questionable.

This is a direct response to Inozemtsev's paper by one of the "alarmists" (in Russian): https://www.moscowtimes.ru/2024/11/25/proshel-god-posmotrim-v-chem-ya-bil-prav-i-v-chem-oshibsya-otvet-vladislavu-inozemtsevu-a148560 , as well as a more recent article by the same author: https://nv.ua/world/geopolitics/voyna-rossii-protiv-ukrainy-kak-dolgo-proderzhitsya-ekonomika-rf-i-budet-li-inflyaciya-ekonomist-50469793.html ,

explaining rather convincingly what might be wrong with an optimistic view of the Russian economy.

…i do not believe it for a fucking second, it’s pure western logic, people who never lived there can only gather information from secondary sources or mafia state itself, midget has no human resources to produce viable and adequate products period and when did gangsters care for economy ?! …mafia state is a mafia state, gangsters never care for the progress or productivity - they are THIEVES, i lived there for over 30 years and i do not believe they are any different today